Sbi Atm Card Application Form

SBI ATM Card Lost – Helpline Number, Complaint Toll Free Number, How to block and get New ATM or Debit Card.

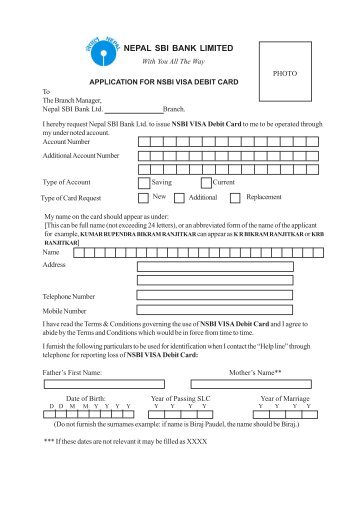

The existing Internet Banking user can apply for a Debit Card using his Internet Banking where some basic variants of the SBI Debit Cards are available for issuance. Customer is required to have PAN card or Form 60, as the case may be, recorded in. APPLICATION FORM FOR ATM CARDS Thank you for applying for the SBI ATM Card. To help us process your request quickly, please fill this form as per the instructions below. If you have any questions, please check with your Branch Manager. We are committed to making your life simpler with the SBI ATM Card. IMPORTANT INSTRUCTIONS. SBI Application Form for ATM Cards. ICICI Bank New Cheque Book Request Form State Bank of Patiala RTGS/NEFT Form IIT JEE Advanced Result 2017 Click on Download Button for State Bank of India Application Form for ATM Cards.

After Losing SBI ATM Card, your first task is to get it blocked. For this, you can call the SBI ATM Helpline and register Complaint. In most cases When SBI ATM / Debit Card is lost a panic is created. So at first I would say that after ATM Card lost you should be patient and keep cool so that you can follow the cautionary steps carefully. You should know that no one can use your SBI ATM Card without getting PIN known and after you register a complaint the Bank bears the transaction of money made by a thief. So, if you have accidentally lost it then no need to worry in most of the cases.

- Application Form for SBI Debit Cards The Branch Manager, Date. Bank means State Bank of India. Card means SBI Debit Card issued to customer. The Bank at its absolute discretion may amend the Terms. Conditions governing ATM services. Please visit or SBI 24 x 7 help line numbers for the updated service charges.

- Oct 17, 2016 2) Ask for the SBI ATM Card Application Form. Alternately, you can Download SBI ATM Card Application Form Online and take a print of it. 3) Fill up the SBI ATM Card Application Form and Submit it the Accounts Official in your SBI Home Branch. Don’t forget to put your Signature in the Application Form.

Now follow the steps after SBI ATM Card lost or theft or stolen call SBI ATM helpline as soon as possible.

You may like to read: Onan generator manual model cck.

Steps to Follow After SBI ATM Card lost

1. Write down the important information of SBI ATM Card lost details in your diary as ATM Card number, PIN, Account Number, Branch Code, Branch Name in your diary.

2. Call to SBI ATM Helpline Number to lodge a complaint. Three numbers are given below. You can call to any of these three.

SBI ATM helpline number

- 1800-112211

- 1800-425-3800

- +91 80-26599990

When the call starts responding tell your problem. The Helpline support staff will ask your name, father’s name, address, date of birth, etc for confirmation purpose. You will have to give an accurate reply of each asked question so that he could assure your identity. After getting these information, SBI will Hotlist your ATM Card umber. A ticket will be generated for this. You should write the ticket number told by the SBI ATM Helpline staff.

After lodging SBI ATM Card lost complaint, a transaction is made by anyone then Bank is liable to the transaction of money.

3. Inform the SBI Branch from where the ATM Card was issued. Write an application to the manager of the branch describing the occurrence of SBI ATM Card lost. Mention your ticket number given by ATM Card Helpline in this application.

How to Block SBI ATM Card through Internet Banking

Yes, Now there is no need to call customer care or run for Branch office to block SBI ATM Card. You can do it by visiting your SBI Internet Banking Website (OnlineSBI). Follow the steps written below to Block SBI ATM Card:

1. Login to SBI Online.

2. Click e-services option on the navigation bar. After then Click Block ATM Card Services link in the left Sidebar. You find a small ATM Card Services page. Click Block ATM Card.

New cutting edge elementary pdf.

3. Click Continue button.

4. Check the tiny rounded box for your Active ATM Card. Fill up your SBI Lost ATM card details and finally click Submit button.

All is done for blocking your lost ATM Card.

Sbi Atm Card Application Form Online Apply

How to Get New SBI ATM / Debit Card, after it is lost

On getting your Application, the Bank will issue a New ATM Card within 2 weeks. In this concern, you will have to pay Rs. 200/-.

SBI has issued ATM card for the convenience of account holders. It has eased the life of people. Imagine when the ATM or Debit card was not available. People who wanted to withdraw money had to go to the branch with the passbook, fill up withdrawal form follow a long queue. Now after getting ATM or Debit card People don’t bother for to go to the branch with the Passbook and fill up withdrawal form to withdraw money. Simply and easily they can go to the ATM, use his card and withdraw after few simple steps. Besides this, you can transfer your money. But if unfortunately it gets lost you will have to follow few norms so that it is not abused by the thief or anyone who gets. But every advantage carries few risks. So after you SBI ATM or Debit card is stolen or lost you have to make a quick response so that you could avoid any malpractice. The SBI Customer Care number or Helpline number of SBI is given above.

State Bank of India is one of the most well-established banks in the country. This public sector bank offers several services to its customers to ensure convenience and easy access to financial assistance when needed. These services are customized to suit the spending habits and requirements of each customer. Therefore, even with ATM cum debit cards, account holders get a wide variety of SBI ATM Card options with each card having its own features and benefits.

Types of SBI ATM Cards

State Bank of India offers 18 types of ATM cards to make daily transactions easier for its account holders. From normal SBI ATM cards to even foreign currency debit cards, SBI account holders can choose from this wide range to manage their finances conveniently.

Atm Application Form Of Sbi

1. State Bank of India ATM Cards

SBI Global International ATM Card

SBI Global International ATM Card |

|

|

|

|

|

|

SBI Gold International ATM Card

SBI Gold International ATM Card |

|

|

|

|

|

|

|

|

|

SBI Platinum International ATM Card

SBI Platinum International ATM Card |

|

|

|

|

|

|

|

|

|

SBI Silver International ATM Card

SBI Silver International ATM Card |

|

|

|

|

|

|

|

SBI Classic ATM Card

SBI Classic ATM Card |

|

|

|

|

|

|

|

SBI Mumbai Metro Combo Card

SBI Mumbai Metro Combo Card |

|

|

|

|

|

|

|

SBIINTOUCH Tap and GO ATM Card

SBIINTOUCH Tap and GO ATM Card |

|

|

|

|

|

|

SBI Pehla Kadam and Pehli Udaan Photo ATM Cards (For Minors only)

| SBI Pehla Kadam & Pehli Udaan ATM Cards |

|

|

|

|

|

|

2. SBI Prepaid Cards

SBI Foreign Travel Card

SBI Foreign Travel Card |

|

|

|

|

|

|

SBI Gift Card

SBI Gift Card |

|

|

|

|

|

|

SBI eZ-Pay Card

SBI eZ-Pay Card |

|

|

|

|

|

|

SBI Smart Payout Card

SBI Smart Payout Card |

|

|

|

|

|

SBI Achiever Card

SBI Achiever Card |

|

|

|

|

|

SBI Noida City One Card

| SBI Noida City 1 Card |

|

|

|

|

|

3. SBI Business ATM Cards

SBI Pride Card

SBI Pride Card |

|

|

|

|

|

|

|

|

|

SBI Premium Card

SBI Premium Card |

|

|

|

|

|

|

|

|

4. SBI Virtual ATM cum Debit Card

SBI Virtual Card

SBI Virtual Card |

|

|

|

|

|

|

|

How to Apply for an SBI ATM Card?

An account holder can apply for an ATM card at the nearest SBI Branch. An account holder can also follow these steps with the net banking portal or mobile banking account to request for a new card:

- Log in to the internet banking or mobile banking account.

- Choose “e-services”

- Then choose “ATM Card services” and click on “Request ATM/Debit Card”

- Authenticate the request with an OTP sent to the registered mobile number.

- The account holder will receive a notification about the duration to issue and deliver the SBI ATM card.

SBI ATM Card Fees and Charges

There are some fees and charges applicable on the SBI ATM Cards, which are as follows:

SBI ATM Card Fees & Charges |

ATM Card Issuance Charges |

|

ATM Card Annual Maintenance Charges |

|

ATM Card Replacement Charges |

|